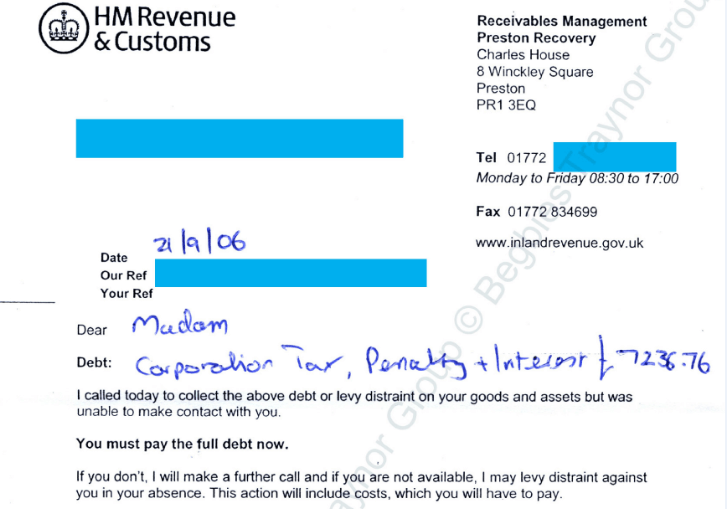

“I called today to collect the above debt or levy distraint on your goods and assets but was unable to make contact with you. You must pay the debt in full now. If you don’t I will make a further call and if you are not available, I may levy distraint against you in your absence. This action will include costs which you will have to pay.

In the event of removal and sale of your goods the following applies:

Corporation tax is a tax charged on company profits, usually levied at 20%. If you are a director of a limited company, it is your responsibility to file accounts and report on your profits accurately in order for HMRC to ensure that the correct amount of tax can be levied.

Corporation tax is mandatory and something you will need to ensure is paid on time – i.e. within nine months of your year-end. If you are unable to do so and have failed to resolve the issue after a period of time – i.e. still unable to pay or have not negotiated a time-to-pay arrangement with HMRC – then it is likely you will receive this letter.

If your company is unable to meet its tax liabilities as and when they fall due, i.e. being unable to pay corporation tax, the company is, therefore, insolvent.

You should speak to a licensed insolvency practitioner (IP) as soon as possible – our team at Begbies Traynor Group includes licensed IPs and business rescue experts who can offer free advice at your convenience.

More Begbies Traynor Articles

Contact Begbies Traynor Group

You're in Safe Hands

Article Archive