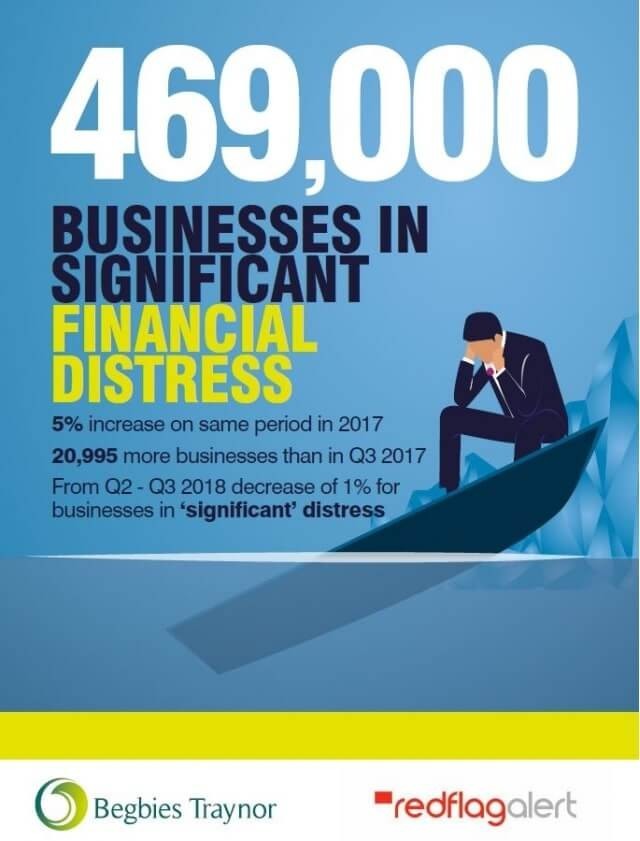

The number of UK companies rated as being in ‘significant financial distress’ during Q3 2018 has increased by 5% compared to the same quarter last year, according to the latest Red Flag Alert research data from Begbies Traynor, the UK’s leading independent insolvency firm.

The research data, which monitors the financial health of UK companies - shows that during Q3 2018, 469,006 companies across the UK were in significant financial distress – an increase of almost 21,000 on Q3 2017. However, significant distress has fallen 1% since Q2 2018 indicating that UK business health may be showing some signs of stability.

Quarterly financial performance has been lifted by a strong summer for some sectors, with food & drug retailers down 2% (Q2: 12,269, Q3: 12,084), construction down 2% (Q2: 60,132, Q3: 59,111), general retail down 2% (Q2: 30,762, Q3: 30,123), printing and packaging down 2% (Q2: 2,228 , Q3: 2,188) and professional services down 2% (Q2: 26,497, Q3: 26,066).

However, the research also reveals this improvement in quarterly performance is not consistent across all sectors, with real estate up 2% (Q2: 42,748, Q3: 43,505) and hotels & accommodation up 2% (Q2: 5,076, Q3: 5,196).

Worryingly, significant business distress increased considerably year-on-year with real estate up 16% (Q3:17: 37,519, Q3:18: 43,505), utilities up 13% (Q3:17: 2,799, Q3:18: 3,153), hotels & accommodation up 10% (Q3:17: 4,717, Q3:18: 5,196) and financial services up 9% (Q3:17: 11,018, Q3:18: 12,049).

Julie Palmer, Partner at Begbies Traynor, said:

“The UK’s barbeque summer – coupled with major events such as the World Cup – provided a feel good bubble for the UK economy. However, the fading of the summer sun has been accompanied by a reality check as consumers tighten their purse strings, with a 0.8% drop in retail sales from August to September, which included the largest decline in food sales since October 2015.

“This change, coupled with falling house prices and higher inflation across key essentials such as energy and fuel, have made UK consumers cautious, particularly as economic certainty around the details of the Brexit deal remain stubbornly elusive.

“While there has been a recent spate of positive company results – particularly those with a strong online offering - there have also been a series of very high profile collapses and profit warnings. While the headlines have focused on the high street, other “bellwether” sectors such as property and financial services, as highlighted in these figures, are showing worrying signs of increasing distress that needs to be addressed if we are to avoid a spiral towards static economic growth.

“With an early budget on the horizon, businesses will be waiting to see what measures the Chancellor can implement to arrest this decline, however the greatest domestic issue remains Brexit uncertainty which is the biggest elephant in the economic room.”

Ric Traynor, Executive Chairman of Begbies Traynor Group plc, commented:

“While the year-on-year increase in the number of businesses in significant financial distress is disappointing, the fall in distress between Q2 and Q3 2018 is particularly welcome.

“This, combined with strong wage growth, demonstrates that the widely anticipated economic meltdown ahead of Brexit has yet to materialise. However both investor and consumer confidence is fragile. An escalation of the trade war between the US and China and EU could have a detrimental impact on the UK, particularly amongst sectors which are heavily reliant on export, such as automotive and manufacturing.

“Businesses with a strong product offering in growing markets will always do well, however all businesses need to focus on the fundamentals – innovation, sales and financial management, as these will be key to staying ahead of both domestic and international competition.

“Those businesses that are quick to adapt in changing times will be the ones that thrive.”

More Begbies Traynor News

Contact Begbies Traynor Group

You're in Safe Hands

News Archive