There has been much made of the Government’s clampdown on what it considers to be corporate tax avoidance in recent years and Accelerated Payment Notices (APNs) are viewed as being a key weapon in HMRC’s battle to deliver increased revenue to the Treasury via a ‘fairer’ taxation system. As Licensed Insolvency Practitioners if you cannot afford to pay back monies owed to HMRC we have created a dedicated insolvency advice line to speak to a senior specialist.

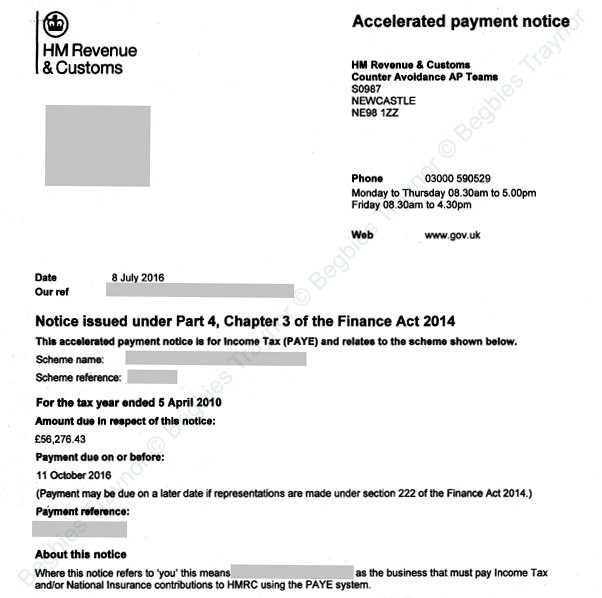

Accelerated Payment Notices are designed to inform companies that they owe taxes which they might otherwise have believed to be beyond the reach of HMRC. The notices amount to demands for payment of monies owed within a period of no longer than 90 days and they do not include any scope for negotiation or appeal on the part of the recipients.

HMRC is currently in the process of sending out APNs to thousands of companies across the UK in an effort to reclaim an estimated £2.1 billion; the result of which has been considerable concern among company directors and sole traders around the UK, many of whom could soon see sizable tax demands being made of them and their organisations that they have not budgeted for.

And, with only three months for the associated payments to be made, the consequences of receiving an APN for some can mean serious financial problems.

Issues relating to tax avoidance have become more prominent in the UK since 2011 with the coalition Government, and particularly Chancellor George Osborne, keen to take a tough line on the matter. The result was that by the Budget 2013, the Treasury had revealed plans to effectively state that previous cases can stand as sufficient grounds for HMRC to send out demands relating to unpaid taxes that were part of tax avoidance schemes.

HMRC was then given “the power to issue a notice to a taxpayer to the effect that a previously decided case also determines their dispute, and that they should therefore settle their own dispute”.

Later in 2013, those powers were reinforced with the Government introducing laws that mean accelerated or upfront payments must now be made by taxpayers who do not settle the debts demanded of them by HMRC. Since that time the focus has been on enforcement and making sure that APNs find their intended targets and are implementable in relation to monies sheltered through any tax avoidance scheme or any other scheme that falls under HMRC’s jurisdiction.

Another aspect the taxation process that more and more companies are becoming aware of are Follower Notices, which HMRC sends out alongside or before it issues an APN. The notices are designed as a deterrent against using tax avoidance schemes with a variety of stipulations outlined to which a recipient must adhere.

Follower Notices also force taxpayers to amend their tax returns where judicial rulings have not been adhered to. Penalties worth up to 50 per cent of taxes due can be charged when a taxpayer does not act properly in response to receiving an official Follower Notice.

To date there have been more than 44,000 APNs sent out around the UK, with 10,000 of the recipients individuals and the remaining 30,000 or so being businesses of varying sizes. HMRC’s position on the issue is summed up by a statement that says the notices will have “no impact on business and civil society organisations who are undertaking normal commercial transactions”.

Or, in other words, those people and companies that have not been seeking to hide their money from the taxman will have nothing to worry about. Although, there are always likely to be grey areas whereby businesses might have believed they were dealing properly with their taxes but in fact find themselves under scrutiny.

Another aspect of the APN regime now in place and in the armoury of HMRC is the Direct Recovery of Debts (DRD), which is another way of saying that money owed to the taxman can be taken directly from your company’s or your personal bank accounts.

DRD powers are only used as a last resort when all other encouragements and instances that payments should be made have gone unheeded. So there should never be a situation in which money is removed from your bank account without prior warning.

However, there are clearly still reasons why an individual or an organisation might be concerned by the prospect of seeing HMRC take money directly from their bank accounts. Not least because it could be that the monies owed cannot be found.

From the perspective of the Government and the Treasury, DRD is an important tool and a vital means of making good on its threats to clampdown on tax avoiders in the same way as already happens in other parts of Europe and in the US.

Chancellor George Osborne said in his 2014 Budget speech that DRD “will focus on debtors who owe at least £1,000 and have been contacted multiple times by HMRC to pay”.

Reassurances have also been given that HRMC will “ensure that a minimum credit balance of £5,000 is available to the debtor across all accounts”.

HMRC made clear though that it will use DRD to recover money owed even where the amounts are within jointly-held bank accounts. “These are not excluded from DRD” and “where a debtor holds an account with another person, 50 per cent of the credit balance could be used to pay the debt,” it has said.

The number of companies being hit with Accelerated Payment Notices continues to rise at pace across the UK and the effects are being felt by businesses across a wide range of industry sectors. Understandably, company directors are becoming more and more worried by the prospect and fearful of what might happen if they receive a notice unexpectedly.

Furthermore, HMRC is expected to continue stepping up its APN processes into 2015 and beyond, backed every step of the way by the Treasury. It is, therefore, highly advisable to seek out expert support and guidance from specialist practitioners such as Begbies Traynor.

The key to successfully dealing with issues around APNs and Follower Notices is to communicate as effectively as possible with HMRC about the details of the situation. The sooner you can get good advice and open up lines of dialogue with the relevant parties, the better your chances are of overcoming any problems.

Begbies Traynor’s team of corporate insolvency experts are currently advising numerous company directors and sole traders on the subject of Accelerated Payment Notices.

More Begbies Traynor Articles

Contact Begbies Traynor Group

You're in Safe Hands

Article Archive

Article Categories