Julie Palmer comments on a HMRC crackdown on unpaid tax in Bloomberg

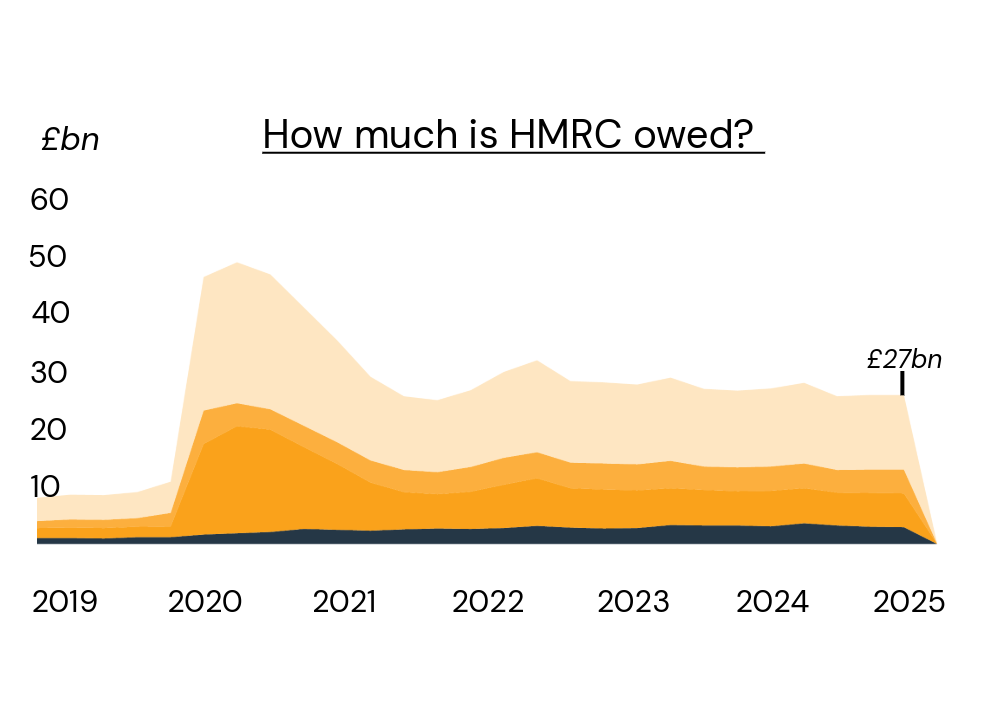

Giving her thoughts to a Bloomberg article, which leads with data obtained by BTG, Julie Palmer, managing partner and restructuring expert at BTG, has noted how HMRC chasing some of the £27.1bn in overdue tax from businesses might trigger struggling ‘zombie’ companies to fall down.

The Bloomberg article notes that HMRC has been patient with late paying businesses in the past, but it is increasing its drive to recoup some of the £27.1bn in overdue corporation tax (£6.1bn), VAT (£12.4bn), and PAYE (£8.5bn).

Julie comments:

“This ramp up of HMRC chasing debts has been well-documented and it is highly likely that we will see a lot of these companies that are saddled with debt falling over.”

A response from HMRC for the article outlined that it offers instalment plans to customers with tax debts, but the agency has a duty to collect the tax it is owed.

Indeed, the data also finds that around 14% of the £27.1bn is tied up in 172,000 Time to Pay arrangements to the tune of £3.8bn. With this option on the table businesses are seeking agreements with HMRC as recalling the debt could be the final straw for some companies – especially those defined as ‘zombies’.

Julie continued:

“We are receiving inquiries from clients asking if we can help them to negotiate with HMRC.

“At the other end of the spectrum, businesses that are succeeding are noting there are many opportunities for acquisition of strong, historic brands and stronger ideas. In some ways, if 'zombie' companies are acquired by better performing and funded ones then there is greater opportunity for improvements in productivity and job creation."

More BTG Begbies Traynor News

Contact the team

Key Contact

You're in safe hands

- 35+ years experience

- 100+ UK offices

- Confidential director support

- Insolvency market leader

News Archive

News Categories