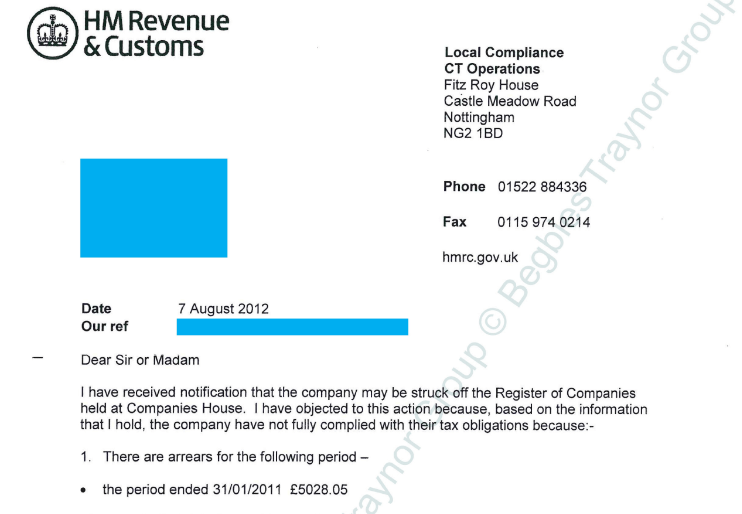

“I have received notification that the company may be struck off the Register of Companies held at Companies House. I have objected to this action because, based on the information that I hold, the company has not fully complied with their tax obligations.

Until these arrears are settled and/or any outstanding Company Tax Returns are received, I cannot agree to the company being removed from the register.”

If a company has been dormant for three months, i.e. no transactions in the company bank account and the business is no longer trading, you can apply to strike off the company with Companies House. But this is only a viable route if your company is up to date with its tax and accounting responsibilities, such as paying corporation tax and ensuring annual returns have been made.

If you apply for striking off, but your company has outstanding liabilities, it is highly likely that the application will be denied, as per the letter above. Sometimes you will receive this letter without even making a striking off application – this is because all companies that have been dormant for a prolonged period and failed to file accounts will eventually be removed from Companies House (i.e. struck off) but at this stage, your tax liabilities will come to light.

In this case, HMRC has clearly objected to the strike off as they are owed for unpaid taxes. If your company is struggling to meets its corporation tax or VAT liabilities, our expert advisors can discuss options to pay off debt to HMRC through a Time to Pay Arrangement (TTP). You can speak with a licensed insolvency practitioner free of charge in a one-to-one setting at your nearest Begbies Traynor office. We specialise in assisting directors in financial distress.

More Begbies Traynor Articles

Contact Begbies Traynor Group

You're in Safe Hands

Article Archive